By sending letters to credit reporting agencies, you force lenders to prove that you owe them money and that they are justified in adding the negative item on your credit report. This useful guide will navigate you through several credit repair strategies. We will give you tips on when and how to use them. Credit reports and credit scores are designed to help lenders.

Debt Validation Letter — Send this letter to validate a debt to the collection agency and ask them to validate a debt they claim you owe to them. Credit Repair Letter Templates : Letters to Send to the Credit Bureaus Credit Inquiry Removal Letter Template Use this letter template if you need to dispute a hard inquiry on your credit report. Letters of credit will help you to repair your credit by yourself. How do credit dispute letters work?

When you send a credit dispute letter to any of the credit bureaus, by law they must investigate and resolve your dispute within days. What is a verification letter? Credit dispute letters can be a sent either by mail or online. Online submissions offer speed and.

In general, credit repair software tools work by scanning your credit reports (entered either manually or automatically through the software) and then allowing you to. Instructional Video Included! The sample credit repair letters have been pre-written and come with directions on how and when to use each letter for a variety of problems. Once you download the set, you can use them again and again as issues arise or as you work over time to repair your credit reports. Otherwise, the alternative to having bad credit come off your credit reports is waiting seven to ten years, the time allowable by law for the credit bureaus to report your credit history, to be dropped from your reports.

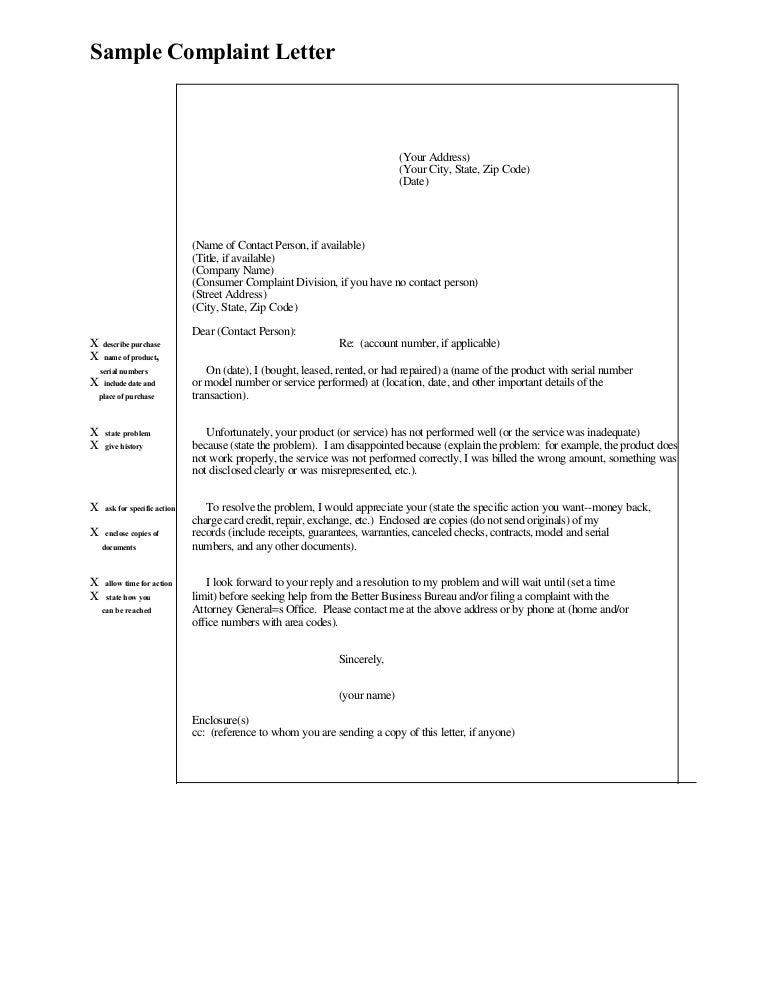

Section 6credit dispute letter sample. How to Write Step – Some Standard Information Should Be Furnished As The Heading. Step – The Template Will Need Situation Specific Facts Presented. The opening or greeting of this letter will begin.

Step – Executing This Letter May Only Be Done Through A Valid Signature. Below is a sample dispute letter disputing a credit card account. Sample Credit Report Dispute Letter.

It can be used for an Equifax, Experian, or TransUnion dispute. Please remember that it’s just an example. It’s intended to give you an idea of what a credit report dispute letter should look like and what it should contain. Explicitly ask for courtesy and to have the item removed form your credit report. If you aren’t confident that you can create the letter from scratch, feel free to use our template.

Negotiating down debt is by far one of the most common reasons a consumer would have for sending a letter to a creditor. Below you will find a sample letter to assist you in crafting your own letter. Keep in min it is always best to seek the advice of an attorney before entering into any type of debt negotiation. Pay for Delete Letter Template for Credit Repair.

Subsequent Disclosure Requirements. Consumer Financial Protection Bureau. If you receive the letter and believe that you do not owe the debt, then you have days from the date you receive the notification letter to dispute that you owe the debt. The CFPB has a letter for that, too. This letter is specifically designed to leverage HIPAA laws.

I recommend you check out the statue of limitation on medical bills as well. If it’s past the statue of limitation you can simply dispute the entry. Novita is not a credit repair company, and does not repair credit on behalf of our users. I am confused to see how many different variations of my name, address, employers and even my birth date is being reported.

Instant Downloa Mail Paper Copy or Hard Copy Delivery, Start and Order Now! Used Books Starting at $3. Free Shipping Available.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.