The financial services value chain has been disintermediated into front , middle , and back offices. This information can help. Notable consistencies can be found between the recent transactions that are likely to change competitive parameters for years to come. The banking industry is highly competitive and apart from entering new markets and finding new customers, it is important that the banks also retain their existing customers.

The internet has completely disrupted the financial services value chain. The banks are struggling to keep up with advancing technology. Understanding mobile, cloud computing, social media, big data and how to utilise each capability are key challenges for the banks to overcome, writes Mike Laven. If you focus on the customer , and specifically on the needs of the customer , you will probably conclude that banks have one value chain for supporting individual and family customers who need financial services.

If there is a differentiation, it is more likely to be between high wealth customers, and average wealth customers. The Business Challenge The client, a leading financial services provider with business operations spread across the globe, wanted to streamline their procurement function to improve productivity, compliance, and inter-department supply-demand visibility as their existing procurement function was highly decentralized and required an innovative solution to make use of its full potential. The traditional VC suits more to manufacturing or products (tangible) then to services – an. In fact, tax authorities around the globe to varying degrees have begun to look to a VCA as part of the process to understand “the big picture” of the whole value chain of a business. In many ways, it provides necessary insights beyond what one would get from mere functional analysis as a result of its enhanced focus on people and specific.

Whether provided by a bank, a buyer or an input supplier, value chain financing allows firms to operate, to transact with others and to upgrade. These buyers and suppliers provide credit to farmers as part of input supply and product purchase transactions. As the lifeblood in the value chain , finance is often one of the critical constraints to economic growth.

Understanding the financial structures both within and between firms in the value chain is necessary for the development of upgrading strategies that effectively increase competitiveness. It helps to fuel many enterprises. Can you believe it’s happened without us?

A new structure for the industry: moving from large one-stop shops to a variety of firms competing at different points in the value chain. Customers buy financial services through distribution platforms separate from product providers. They have many more firms supplying services.

The dialogue included numerous interviews and interactive sessions to discuss the insights and opportunities for collaborative action. These companies are reaching ever further across the financial services value chain , from banking to insurance, wealth management, and payments. A value chain is a tool for constructing relationships in order to identify profit areas and competitive differentiators. Unfortunately, a value chain is not static and demands constant attention, evaluation, and updating in order to keep up with business progress. The visibility and transparency created by the blockchain-enabled platform generates a greater level of trust between all companies in the value chain , opening the door to more collaboration and innovation.

A conceptual framework which examines how the particular activities undertaken in a firm creates VALUE either through their impact on cost or through the benefits they provide customers (see VALUE CREATED MODEL for details). At its core, the research is built on a thorough disaggregation and mapping of costs and full-time employees (FTEs) along the insurance value chain , ensuring that all types of costs are included in a comparable way across all participating insurers. Lea Nonninger and Mekebeb Tesfaye. T17:55:00Z The letter F. The purpose of value - chain analysis is to increase production.

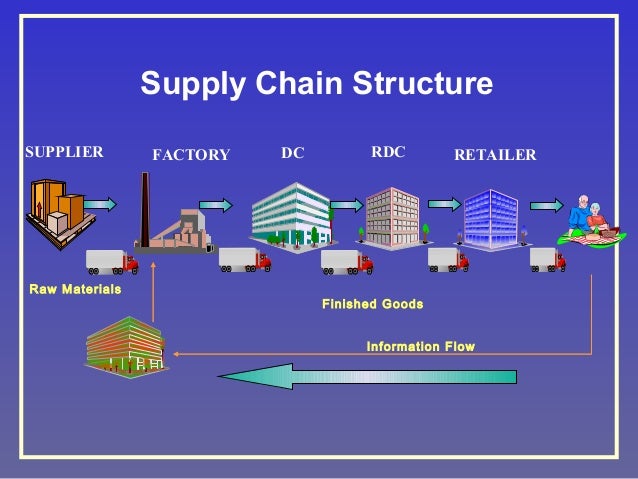

For business associations lacking formal legal status, they are unable to access financial services that would otherwise grow their businesses. What are their expectations and what services do they expect their banks to provide. By connecting business partners from order placement to settlement, the financial supply chain carries the flow of financial information in the direction opposite to the flow of goods and services. Let us take the example of mining industry value chain to illustrate it.

Figure brings out the types of mined materials and their importance in our lives while Figure provides an overview of the key stages in the mining industry value chain. Financial services is no different.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.