Individuals starting your own. Generally, businesses need an EIN. You may apply for an EIN in various ways, and now you may apply online. The person applying online must have a valid Taxpayer Identification Number (SSN, ITIN, EIN). You are limited to one EIN per responsible party per day.

The “responsible party” is the person who ultimately owns or controls the entity or who exercises ultimate effective control over the entity. You can validate TIN and name combinations prior to submitting information returns. Daily Limitation of an Employer Identification Number. This limitation is applicable to all requests for EINs whether online or by fax or mail. See full list on apps.

Stimulus check information. Apply for EIN Number. There are many kinds of TINs given to various individual and group entities for the purpose of official identification on any number of public and private documents. Search using CAC Registration Number. Select CAC Registration number in the search criteria dropdown list then enter the Number Registered with Corporate Affairs Commision preceeded by the corresponding alphabets e. Tax Preparation Tools.

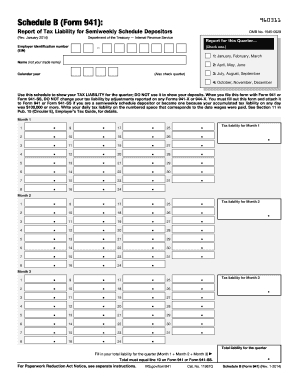

Easy, Quick, and Secure Filing. Internal Revenue Service (IRS) and is required information on all tax returns filed with the IRS. Businesses, local or state government agencies, and Non-Profit organizations have to possess an EIN for IRS tax purposes.

EINs are used by the IRS, the government, and other companies, agencies, and systems, to identify the entity. Our EIN form is simplified for your ease of use, accuracy, and understanding, saving you time! The number´s holder keeps the same number throughout its legal existence. Once the holder´s legal existence expires, the number is never reassigned.

There are several types of TINs that vary according to taxpayer category. But some non-citizens who have U. Filing for an Employer Identification number (EIN) can be strenuous at times, that is where we come in, to alleviate that burden. Social Security number. Your trust’s tax ID will be a nine-digit number specific to your trust.

Whether your business is an LLC, C-Corp, or S-Corp or even a sole proprietor, or if you have a trust – it doesn’t matter. In Ghana, apart from Paying taxes, TIN is used for other services like importing goods into the country and registering a business or land. Listen carefully to the options provided.

After dialing the number , listen to the prompts and choose option then option 1. Tip: To avoid long hold times, call the IRS number as early in the morning as possible. A tax ID number , also known as a TIN, is an identifying number used for tax issues in the United States of America. The tax ID number of an estate is known as an employer identification number , or EIN. It is an electronic system of taxpayers’ registration, which would uniquely identify all taxpayers and would be available nation wide. It is a nine-digit number that always begins with the number and has a range between and in the fourth and fifth digit, example 9XX-70-XXXX.

The IRS must have the correct contact person and information of the business or entity in case there is a tax matter which they need to discuss with the responsible party.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.